tax strategies for high-income earners 2020

Read customer reviews find best sellers. The average annual amount will be 25900 if married filing jointly or the maximum of 5 for those who are.

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Tax strategies for high-income earners 2020.

. How to Reduce Taxable Income. Build Your Team of Professionals You might build a. Ad Work one-on-one with a JP.

July 24 2020 225242. Creating retirement accounts is one of the great tax reduction strategies for high income earners. Explore a free investment check-up and see where you are on your path toward your goals.

If youre over 55 you can. Consider using above-the-line deductions to help. Currently there will be a 12 deduction for a single person in 2020.

6 Tax Strategies for High Net Worth Individuals. Lets review five of the most highly effective retirement tax strategies for high income earners. For example a single taxpayer earning up to 9950 will pay around 10 of their taxable income.

Second you meet your required withdrawal for the year. These changes are significant because they make it possible for high-income earners to make additional contributions to a retirement plan during the tax year. New Look At Your Financial Strategy.

As of 2020 you can contribute up to 3500 per year as an individual or up to 7100 on behalf of your family. One out of the many. Several significant changes affect tax reduction measures for high-income individuals.

Take Advantage of Pre-Tax Savings Opportunities. In 2020 the age for Required Minimum Distributions or RMDs was raised from 70. However if that single person earns more than 523600 that year they will pay taxes of 37.

If you are a high earner with an income above the IRSs income limit for Roth IRA accounts you still have the option to create a backdoor Roth IRA. Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners. Here are helpful tax strategies for high-income earners that help increase savings.

Other than the reality you need a comfortable retirement putting resources into particular kinds of retirement accounts is one the best tax strategies for high income earners. An Edward Jones Financial Advisor Can Partner Through Lifes Moments. Third you reduce your tax.

All contributions that you make are tax-deductible. Visit The Official Edward Jones Site. Morgan Advisor design an investment strategy for your needs.

Thankfully there are some tax strategies for high income earners you can do now to keep from overpaying this tax season. With a CRT high-income earners and small. First you give to a charity which helps the charity and likely makes you feel good.

Your Slice of the Market Done Your Way. A Solo 401k for your business delivers major opportunities for huge tax. If your work or assets generate.

A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT. Browse discover thousands of brands. The law permits you to deduct the amount you deposit into a tax-certified.

The law permits you to deduct the amount you deposit into a tax-certified. A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. A donor-advised fund DAF is an investment account created to.

An overview of the tax rules for high-income earners. Tax Strategies for High-Income Earners.

Millionaires And High Income Earners Tax Foundation

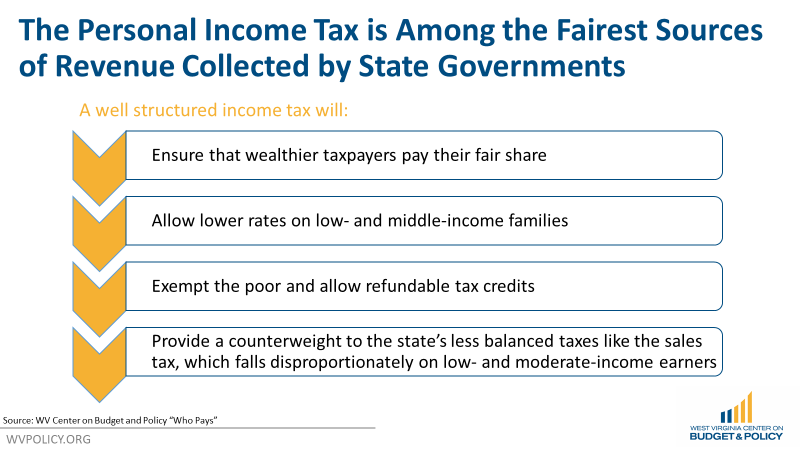

Eliminating The Personal Income Tax Ineffective Policy That Would Harm Working Wv Families West Virginia Center On Budget Policy

What You Need To Know About 2020 Taxes Advisors Management Group

9 Ways For High Earners To Reduce Taxable Income 2022

How To Reduce Virginia Income Tax

What Are Marriage Penalties And Bonuses Tax Policy Center

Tax Strategies For High Income Earners 2022 Youtube

![]()

Tax Time Preparation For 2020 Tax Time Online Taxes Tax Refund

Tax Strategies For High Income Earners Wiser Wealth Management

How Do Taxes Affect Income Inequality Tax Policy Center

9 Ways For High Earners To Reduce Taxable Income 2022

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Tax Time Preparation For 2020 Tax Time Online Taxes Tax Refund

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

5 Outstanding Tax Strategies For High Income Earners

Amazon Com Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes 1 9781734792607 Mackwani Adil N Books

Tax Strategies For High Income Earners Wiser Wealth Management